Exchange differences on borrowings in foreign currencies, but only those representing the adjustment to interest costs. During this process we raised rents by ~$1,000 per month across the 12plex and drastically lowered future expenses, raising NOI by $24,000 per year. All in — we spent all of the rent from the property on renovations.

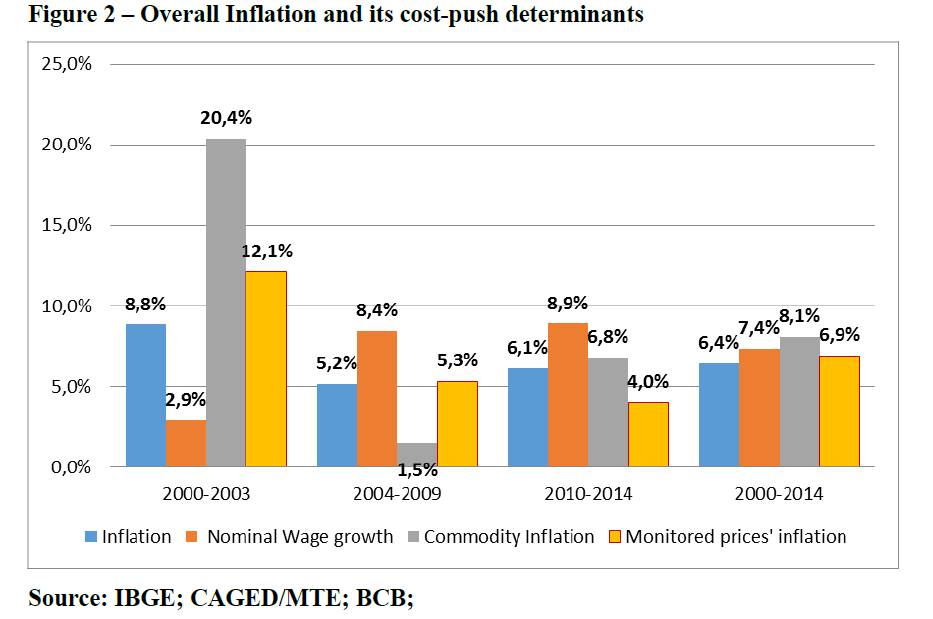

Simplify the process of reviewing, vetting, and purchasing properties with Reonomy. It is a useful model to consider, though understanding its assumptions are important. For example, if the growth rate outstrips the discount rate, a nonsensical negative value would result. The extent of this can be seen in the graph below, taken from Cushman and Wakefield’s 2017 cap rate report.

In such a time, politicians, bankers, investors, and ordinary home buyers mutually bolster the real estate market. The collective engagement in the housing business turned particularly forcible in the United States from the beginning of the 2000s when buying a house became an attractive way of investment. Most of us know or even experienced the disastrous effect of the 2008 financial crisis which was the culmination of the extended period of zealous rush in the real estate market. Probably the best way to understand how applying the capitalization rate helps in property evaluation is to look at a real-world example. Let’s say you are considering selling your house, and after some research, you see that investors are buying properties like yours at a 10 percent capitalization rate. For example, imagine that you bought an apartment for $100,000, and the cap rate is 10%.

Gross Income

But as we always say, only one or two ratios are not enough to create clarity within the mind of an investor. The investor needs to look at all the ratios and net cash inflow to get a big picture of the firm before actually investing in it. DetailsIn US $EBIT 75,000Interest Expense 20,000Interest-Coverage Ratio (5/4)3.75In this case, the interest-coverage ratio is quite good. That means the firm has good standing in terms of income, even if the capitalization ratio is much lower. To understand the whole picture, we need to look at all the firm’s ratios and then decide whether investing in the firm is a good idea.

Financial advisors are trained professionals who will not only be a good sounding board for you, they will also help you identify investments that make sense for you and your goals. There are three conventional ways of property valuation, and they all rely on the basis of comparison. It is not the way on which you should ever base your final decision, though it can give you a quick initial idea if it’s worth spending more time to check the offer in detail.

Understanding relative performance can be achieved by looking at the cap rates of comparable properties ormarket cap rates. Since cap rates are not fixed, the measurement of what a good cap rate isn’t either. Evaluating whether the cap rate of a property is good comes down to a measure of relativity.

What Is A Good Cap Rate & How To Calculate It

The only difference between the previous ratio and this one is the inclusion of short-term debt. This ratio will look at total debt and determine the proportion of total debt compared to capitalization. It is a standard measurement in the real estate industry for evaluating potential investments.

Begin with determining the property value – it can be, for example, its selling price. Finally, if the passing rent payable on a property is equivalent to its ERV, it is said to be “Rack Rented”. Written-down value is the value of an asset after accounting capitalization rate for depreciation or amortization. The Structured Query Language comprises several different data types that allow it to store different types of information… Current market value of the asset is the value of an asset on the marketplace.

- The Capitalization Rate may consider various factors, but it does not reflect the future risk.

- This can be used to assess the valuation of a property for a given rate of return expected by the investor.

- The cap rate is most useful as a comparison of the relative value of similar real estate investments.

- Market capitalization is the dollar value of a company’s outstanding shares and is calculated as the current market price multiplied by the total number of outstanding shares.

When this is not available, say if the property is being considered as an off-market acquisition, determining the current market value is another step to consider when calculating the cap rate. However, a lower cap rate also means that the property is a safer or lower-risk investment, while a higher cap rate means more risk. Understanding what the cap rate is, how it works, and alternative calculations for evaluating financial potential are critical before purchasing a new investment property. Your gross rental income (assuming 100% occupancy) is $60,000, your occupancy rate is 85%, and your operating expenses are $15,000.

It’s simple; we will check out the proportion of debt in the total capital. To understand this, we need first to understand the capital structure. However, cap rates fluctuate, and predicting where they will be in, let’s say, ten years can be a challenging task, as a WSO forum user has remarked below.

The Gordon Model works for investors who predict NOI will grow at a constant rate each year. For this model, divide cash flow by the difference between the discount rate and the constant growth rate . Your property will incur several expenses such as maintenance, insurance, taxes, and more. Tally up these expenses and deduct them from net operating income. After deducting operating costs, you’ll know the net operating income.

In this case, you need to apply so-called capitalization rate to the borrowing funds on that asset, calculated as the weighted average of the borrowing costs applicable to general pool. Calculated by dividing a property’s net operating income by its asset value, the cap rate is an assessment of the yield of a property over one year. For example, a property worth $14 million generating $600,000 of NOI would have a cap rate of 4.3%. That means that you can expect a roughly 4.3% annual operating cash flow given the price paid for the property.

However, the definition of a good cap rate can vary dramatically depending on your situation, market, neighborhood, and overall risk tolerance. Determine the value of a current or prospective investment property using these free cap rate calculators. Use the first calculator to find the cap rate, and use the second calculator to estimate your property valuation based on its net operating income and cap rate. Investors want to make sure they get a good deal on a property. Each property is a significant investment between the down payment, management, and other expenses. The cap rate real estate metric helps investors determine if they’re getting a good deal and avoid overpaying.

Treasury and Payments

One of the primary benefits of the cap rate is that it helps investors decide whether or not to acquire a property. An asset with a higher cap rate is a usually good buy than the one with a lower rate under a similar set of conditions. So let us take the above example further and assume that there is a crash in the real estate prices meanwhile. And now, the value of the same piece of land is worth $200,000, and it is likely to generate $50,000 annually. Cap rate does not include mortgage, which allows you to accurately assess the return on investment on a property, helping you find the best deal for you. Including your mortgage will allow you to find the levered yield.

Qualifying assets are assets that take a substantial period of time to get ready for their intended use or sale. Unfortunately, this choice was removed a few years ago for most of assets, and now you have to capitalize. We’ve partnered top agents that specialize in investment properties across the country, from major brands and top-rated local brokerages.

Again, the measurement of any cap rate and it’s subsequent performance vary based on the property type and the location of that property. Like any other financial forecasting, the forecasting of cap rates attracts a range of opinions/predictions. Instead of working through hours of long equations and phone calls with sellers, investors can simply look up a property’s value, NOI, and cap rate on Reonomy. Given that real estate market conditions are the best they’ve been in some time, investors are likely looking to make purchases now while the odds are in their favor. Further complicating the issue of cap rates is the fact that they are subject to market trends at the local, state, and even national level.

The cap rate is the most popular measure through which real estate investments are assessed for their profitability and return potential. The cap rate simply represents the yield of a property over a one-year time horizon assuming the property is purchased on cash and not on loan. The capitalization rate indicates the property’s intrinsic, natural, and un-levered rate of return.

Calculating Current Market Value

It excludes non-operating costs such as loss on sale of a capital asset, interest, tax expenses. Let’s say a rental property gets $ 1,000 gross income every month. The owner is liable to annually pay $ 700 for property management and maintenance, $ 500 for property taxes, $ 250 for insurance.

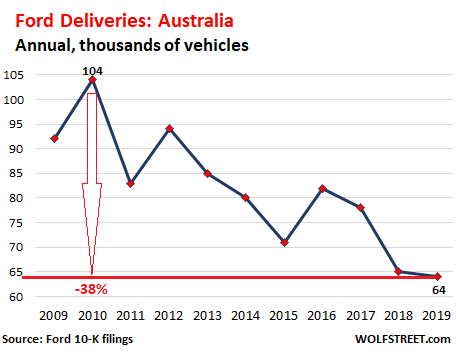

This trend is part of what makes real estate such an attractive investment. However, while real estate tends to appreciate in value the exact rate can be hard to predict. Instead, investors need to look at other signs the market is growing such as new businesses, and increase in residents, and more. This relation is because the amount of money you can make investing in government bonds increases, which becomes a more attractive option, increasing the risk of investing in something else. There are multiple financial ratios that can support the decision-making when you are about to buy or sell a property.

If you have a contractual right to receive that interest, then it is Debit Loan receivable (maybe some sub-account for better records) / Credit Interest revenue. And debenture stock were taken for no specific purpose and KLM used them to finance general spending and the construction of a new machinery. General borrowings are those funds that are obtained for various purposes and they are used also for the acquisition of a qualifying asset. Gains or losses arising from early repayment of borrowings, etc. After diving into the numbers a bit more, I call back the agent and let them know I’m going to pass.